O farnosti

Kostel sv. Matěje

Objevte příběh kostela sv. Matěje, významné náboženské a kulturní stavby, jejíž počátky jsou v kronikách spojovány již s rokem 971.

Více o našem kostelu

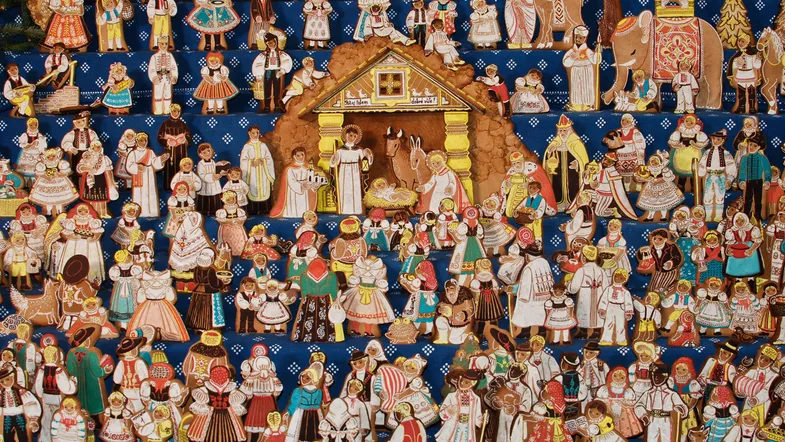

Perníkové jesličky

Tradice svatomatějského perníkového betlému sahá až do roku 1972. Přečtěte si více o jeho historii a současnosti.

Více o perníkových jesličkách